The Characteristics of a Happy Marriage

19 آگوست, 2021Celebrities who have died from addiction

3 سپتامبر, 2021How to Calculate CapEx Formula

The income statement reports income at the top and expenses below, with the net income– or net profit– reported on the bottom line. Automate manual processes, generate accurate forecasts, reduce errors, and gain real-time visibility into your cash position to maximize your cash flow. Investments in capital expenditure help in long-term financial sustainability by supporting growth initiatives, and mitigating financial risks. CapEx allows companies to invest in growth opportunities that can contribute to their long-term sustainability. Let’s consider a company that manufactures electronic devices and has been operating from its current facility for over a decade now.

CapEx vs OpEx

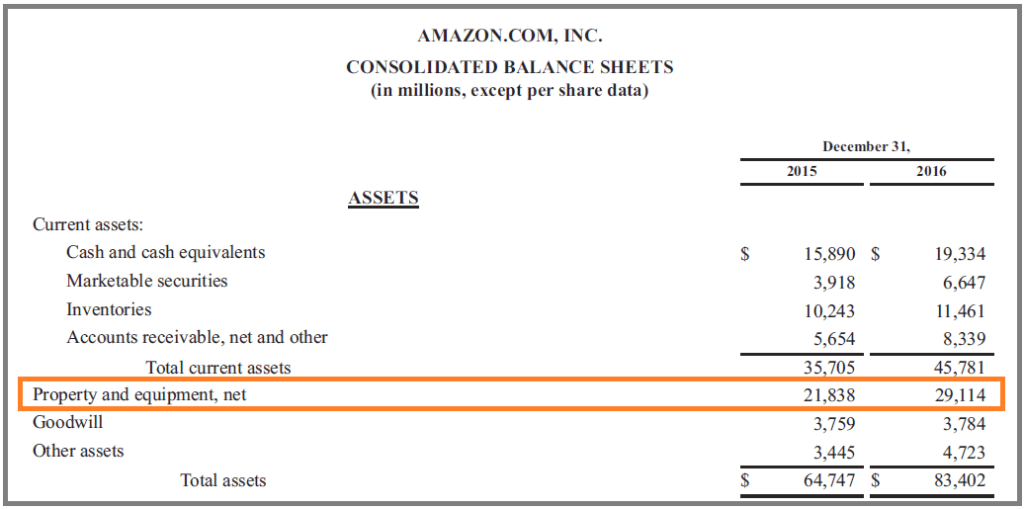

Any spending on new server equipment and storage held in-house would be considered CapEx. Note that you can also find it in a company’s Cash Flow Statement (aka Statement of Cash Flows). The key takeaway is that depreciation is added to the change in PP&E in order to calculate Capital Expenditure. PP&E is found on a company’s Balance Sheet (aka Statement of Financial Position).

- A note, you will have years where there is negative sales growth.Negative sales are ok and expected from time to time.

- A company that buys expensive new equipment would account for that investment as a capital expenditure.

- CapEx purchases are recorded as assets on the balance sheet of the company’s financial statements, rather than expenses on the income statement.

- Thus, they should be given the opportunity to provide input on capital expenditure budgeting.

Types of Capital Expenditures

The purchase of a building, by contrast, would provide a benefit of more than 1 year and would thus be deemed a capital expenditure. For example, the maintenance capex in Year 2 is equal to $71.3m in revenue multiplied by 2.0%, which comes out to $1.6m. In periods of economic expansion, the percentage of growth capex also tends to increase across most industries (and the reverse is true during periods of economic contraction). Since the increase or decrease in PP&E reflects the Capex spend, the annual depreciation recognized in the same period is added back because the expense is a non-cash item. A company may acquire another business to expand its operations or gain access to new markets, customers, or products.

Ask a Financial Professional Any Question

Negative capital expenditure implies a decrease in investments in long-term assets. Depreciation is included in the formula because it represents the annual reduction in the value of long-term assets due to wear and tear or obsolescence. Including depreciation in the procedure accounts for the impact of asset depreciation on the company’s capital expenditure. The assets in discussion here could be machinery, facilities, technology, or infrastructure such as buildings, offices, or plants. These expenditures are imperative for organizations as these become the tools for the production of their products or services that in-turn generate revenue, and ultimately profits. Knowing all of this information can significantly contribute to the future growth of your business.

What is maintenance capital expenditure?

A company may spend money on upgrading its existing facilities to improve efficiency, increase capacity, or enhance its safety features. Depreciation expense is the portion of the asset’s cost allocated to each year of its useful life. Several methods can be used to calculate depreciation, but the most common are the straight-line and accelerated methods.

Property, Plant and Equipment

CapEx is reported on the balance sheet as an asset because it provides ongoing value to the company over many years. Although it is a cost incurred by the company, it does not appear immediately on the income statement. Instead, the asset is depreciated over many years according to its useful life.

Not every company will list it directly as maintenance CapEx; some willlist it as additions to property, plant, and equipment. Whether a high capital expenditure (CAPEX) is good or not for a company depends on the context and the specific circumstances of the company. It is possible for a company to have negative CAPEX, although it is relatively uncommon. Negative CAPEX typically occurs when a company sells or disposes of its long-term assets, resulting in a reduction in its PP&E balance. While companies may vary in the ways they report CapEx, you can learn how to track past trends in CapEx to obtain a better understanding of how a company is growing. Thus, it’s important for investors to analyse a company’s CapEx in conjunction with its other activities.

If you don’t have access to the cash flow statement, it’s possible to calculate the net capital expenditure if depreciation is broken out on the income statement (which most, but not all, companies do). If a company’s maintenance CapEx is relatively high, the company’s freecash flow will be relatively low. Free cash flow is the cash available forrepaying debt and making dividend distributions after operating expenses andcapital expenditure commitments are paid. The above calculation shows that the wireless headphone company spent $500,000 in capital expenditures for 2022. On its own, accountants can track CapEx annually to see how a company is investing in future growth and expansion or how it has benefited from the sale of long-term assets. The depreciation (or amortization for intangible fixed assets) is the annual amount of the fixed asset investment that was spread out over the asset’s lifetime.

The CapEx metric is used in several ratios for company analysis in addition to analyzing its investment in its fixed assets. The cash-flow-to-capital-expenditures (CF-to-CapEx) ratio relates to a company’s ability to acquire long-term assets using free cash flow. The CF-to-CapEx ratio will often fluctuate as businesses go through cycles of large and small capital expenditures. Externally, investors may how to find capex consider a company’s annual capital expenditures to get an idea of how the company is investing in future growth. However, they would also consider other factors, like the company’s annual cash flows and net working capital. Moreover, if expenditure is a capital expense, it should be essentially capitalized, which requires the company to increase the cost of expenditure over the assets’ useful life.

In other words, CAPEX represents investments in the future growth and profitability of the company. Whether you’re an entrepreneur, or a business owner, understanding how to calculate CapEx is crucial to managing finances and making informed investment decisions. Capital Expenditure refers to the funds a company invests in its fixed assets, such as property, equipment, or machinery. These investments are made to improve the company’s productivity, efficiency, and profitability in the long term.