Foreign Currency Trading For Novices Pdf Forex Information Ifcm India

26 آگوست, 2023Алгоритмы шифрования: обеспечение безопасности связи в квантовую эпоху Песочница Хабр

20 سپتامبر, 2023The Advantage of the FIFO Inventory Method

To understand the underlying principles of the FIFO method, imagine your inventory as a queue or a line of items. The newest additions are placed at the back, while the oldest items occupy the front position. When it’s time to consume or sell items, the ones at the front of the line are selected first.

When to Use the FIFO Inventory Method?

Consider factors such as product demand, shelf life, storage requirements, and turnover rates. Understanding your specific inventory characteristics will guide you in determining the most suitable application of the FIFO method for your business. The key term here is interpretation, as these methods are used for reports and the inventory amount is an estimate, not an exact value. It’s an estimate that is calculated by a variety of methods, each resulting in a different number. So, LIFO and FIFO do not reflect what has actually happened in a company’s bank account, rather, it’s just how they are reporting it. Obsolete inventory refers to inventory that is old or outdated and is not suitable for sale or use in production.

What is LIFO?

We will also provide detailed examples to illustrate its implementation across different industries. By the end of this guide, you will have a solid understanding of the FIFO method and how it can optimize your inventory management processes. Welcome to our comprehensive guide on the FIFO (First In, First Out) method in inventory management. As an operations professional, you understand the critical role of efficient inventory management in the success of any business.

Allows businesses to respond quickly to changes in customer demand

Using the FIFO method also helps businesses minimize losses from price fluctuations. By ensuring that the first inventory sold comes from the oldest items in stock, businesses can avoid having to sell newer and more expensive items at the same price as older, cheaper items. This helps to ensure that businesses are not losing money due to market changes or their own pricing decisions. FIFO is an inventory management method that follows the principle of “first in, first out.” As mentioned, this means that the oldest products in a warehouse are the first to be sold or used. Same principles can be applied for first expired, first out, using expiration date instead of receipt date. FIFO, preferred under IFRS, showcases a stronger financial position by reporting lower COGS and thus higher net income, beneficial during inflation.

- The FIFO method, while beneficial in many scenarios, does have some drawbacks.

- This means that your business will be worth more to potential buyers or investors.

- With FIFO, older inventory is theoretically purchased at a lower price than newer inventory.

- Consider the following practices to ensure your FIFO calculations are accurate and up to date.

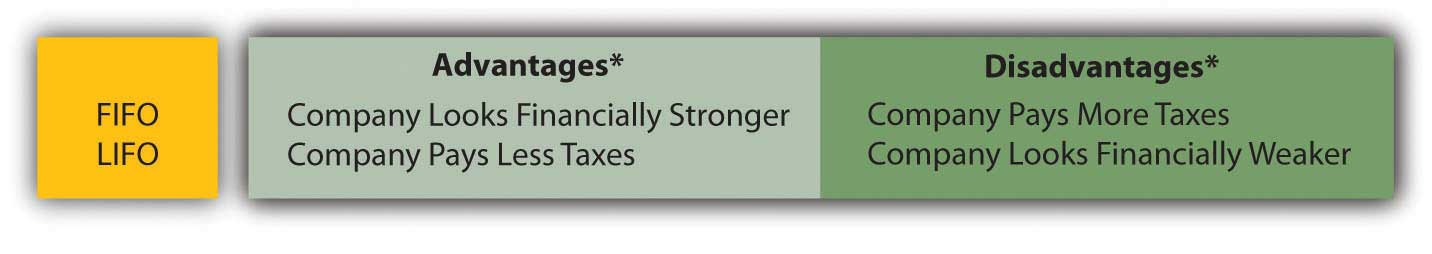

FIFO vs LIFO: Advantages & Disadvantages

This method also aids in compliance with food safety regulations and maintaining customer satisfaction by ensuring that the freshest products are available for sale. First in, first out (FIFO) is an inventory method that assumes how to pass journal entries for purchases accounting education the first goods purchased are the first goods sold. This means that older inventory will get shipped out before newer inventory and the prices or values of each piece of inventory represents the most accurate estimation.

Accurately Calculate Income Taxes

In addition, consider a technology manufacturing company that shelves units that may not operate as efficiently with age. For example, a company that sells seafood products would not realistically use their newly-acquired inventory first in selling and shipping their products. In other words, the seafood company would never leave their oldest inventory sitting idle since the food could spoil, leading to losses. Determine the cost of the oldest inventory from that period and multiply that cost by the amount of inventory sold during the period. Now, let’s assume that the store becomes more confident in the popularity of these shirts from the sales at other stores and decides, right before its grand opening, to purchase an additional 50 shirts.

Utilizing FIFO ensures that earlier stock is dispatched first, reducing the likelihood of selling outdated models or designs. FIFO’s widespread acceptance and straightforward logic mean it is supported by the majority of accounting and inventory management software. Mobile inventory management solutions like RFgen can automatically enforce FIFO rules in the warehouse.

The FIFO method’s logical approach to inventory flow makes cost tracking and calculation easier. This simplicity reduces accounting errors, speeds up month-end closings, and streamlines audits. The simplifies onboarding for new employees and streamlines accounting processes, which reduces overall operational expenses.

By prioritizing the consumption or sale of older items, businesses can minimize product obsolescence, accurately calculate costs, and enhance inventory valuation. Utilizing the FIFO method also helps businesses to accurately calculate their COGS and inventory valuation. This is because the oldest items are being used to fulfill customer orders, meaning that their costs are reflected in COGS instead of more expensive new items. The FIFO system helps businesses with managing inventory by ensuring that the oldest products are sold or used first. This reduces the risk of having to dispose of outdated products and minimizes inventory spoilage.

Often compared, FIFO and LIFO (last in, first out) are inventory accounting methods that work in opposite ways. Where FIFO assumes that goods coming through the business first are sold first, LIFO assumes that newer goods are sold before older goods. Using the FIFO method makes it more difficult to manipulate financial statements, which is why it’s required under the International Financial Reporting Standards. Depending upon your jurisdiction, your business may be required to use FIFO for inventory valuation.